maykopmassive.ru

Prices

Rates For Mortgage Loans Today

The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 31 pm EST. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Current Reverse Mortgage Rates: Today's Rates, APR | ARLO™ ; Fixed Rate, Adjustable Rate, Lending Limit. % (% APR), % ( Margin) ; Fixed. Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $ ; year fixed, % (%), $ ; year fixed, % . Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 % ; VA Jumbo Purchase Loan, InterestSee note1 %, APRSee note2. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The current mortgage rates stand at % for a year fixed mortgage and % for a year fixed mortgage as of August 31 pm EST. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Current Reverse Mortgage Rates: Today's Rates, APR | ARLO™ ; Fixed Rate, Adjustable Rate, Lending Limit. % (% APR), % ( Margin) ; Fixed. Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $ ; year fixed, % (%), $ ; year fixed, % . Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 % ; VA Jumbo Purchase Loan, InterestSee note1 %, APRSee note2. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %.

Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. A Homebuyers Choice loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, A Jumbo Homebuyers Choice loan of. Average Mortgage Rates, Daily ; 3 Year ARM. %. % ; Jumbo. %. % ; VA. %. % ; FHA. %. %. All loans are provided by PNC Bank, National Association, a subsidiary of PNC, and are subject to credit approval and property appraisal. equal housing lender. National year fixed mortgage rates go down to %. The current average year fixed mortgage rate fell 2 basis points from % to % on Friday. What are today's mortgage rates? The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year. Compare Purchase Mortgage Rates ; Mortgage interest rates for KeyBank clients in Alaska · % · % ; Mortgage interest rates for KeyBank clients in Colorado. Today's Mortgage Rates. Mortgage rates change daily based on the market. Here are today's mortgage rates. Daily Rate Sheet ; 10 Year Fixed, %, % ; 15 Year Fixed, %, % ; 20 Year Fixed, %, % ; 30 Year Fixed, %, %. Current Mortgage Purchase Rates ; Yr JUMBO Fixed · %, %, % ; Yr FHA · %, %, %. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Today's Mortgage Rates ; Year Fixed-Rate Home Equity Loan. Up to $, % ; Year Investment-Property Mortgage. Fixed Rate, Conforming or Jumbo. Today's Rate on a FHA Year Fixed Mortgage Is % and APR % · View Advertising Loan Disclosures. With an FHA year fixed mortgage, you. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $1, at an interest rate of %. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Home equity loans ; Home equity line of credit · %, % Variable ; year fixed home equity loan · % · %. Compare our current interest rates ; year fixed, %, % ; year fixed, %, % ; FHA loan, %, % ; VA loans, %, %. At a % interest rate, the APR for this loan type is %. The monthly payment schedule would be: payments of $2, at an interest rate of %. Today's Commercial Mortgage Rates ; AGENCY SBL, %, % ; CMBS, %, %

Fully Amortized Mortgage Calculator

Use our free amortization calculator to quickly estimate the total principal and interest paid over time. See the remaining balance owed after each payment. payment period. The rounding option is for comparison with other calculators that do not round the payment or maykopmassive.ru: The spreadsheet is only valid. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. This calculator will calculate an uknown payment amount, loan amount, rate, or term. What is an amortization schedule? An amortization schedule is the loan. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. Create an amortization schedule payment table for loans, car loans and mortgages. Enter loan amount, interest rate, number of payments and payment frequency. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest. Use our free amortization calculator to quickly estimate the total principal and interest paid over time. See the remaining balance owed after each payment. payment period. The rounding option is for comparison with other calculators that do not round the payment or maykopmassive.ru: The spreadsheet is only valid. An amortization schedule is a table showing regularly scheduled payments and how they chip away at the loan balance over time. This calculator will calculate an uknown payment amount, loan amount, rate, or term. What is an amortization schedule? An amortization schedule is the loan. Use this simple amortization calculator to see a monthly or yearly schedule of mortgage payments. Compare how much you'll pay in principal and interest and. Loan Calculator with Amortization Schedule. Print-Friendly, Mobile-Friendly. Calculate Mortgages, Car Loans, Small Business Loans, etc. Use our amortization schedule calculator to estimate your monthly loan repayments, interest rate, and payoff date on a mortgage or other type of loan. Create an amortization schedule payment table for loans, car loans and mortgages. Enter loan amount, interest rate, number of payments and payment frequency. Use our loan amortization calculator to explore how different loan terms affect your payments and the amount you'll owe in interest.

This calculator shows a "fully amortizing" ARM, which is the most common type of ARM. The monthly payment is calculated to pay off the entire mortgage balance. Choose installment loan a that is fully amortized over the term. This option will always have a term that is equal to the amortization term. Choose balloon to. It will calculate your monthly mortgage payment for any loan amount and interest rate. Second, it will show you how fast you'll pay down your mortgage. Curious to see how much principal and interest you will pay over the life of your loan? Input your information into our amortization calculator to see a month-. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. It also calculates the monthly payment amount. mortgage or an adjustable rate mortgage (ARM), will be better for you when buying a home. The calculator also compares fully amortizing or interest-only ARMs. This same process repeats every month until your loan is completely paid off. mortgage calculator. This is useful to know when it comes to amortization. amortize until it is completely paid-off. Balloon loans, or bullet loans, operate under a different set of rules than standard amortizing loans. While both. By the end of the loan term, if your loan is fully amortizing, then both the principal and the interest will be paid off. Understanding a Loan Amortization. Our loan calculator will help you generate monthly and yearly amortiztion schedules for any proposed loan. Find your monthly payment, total interest and. This amortization calculator shows the schedule of paying extra principal on your mortgage over time. See how extra payments break down over your loan term. This calculator will figure a loan's payment amount at various payment intervals - based on the principal amount borrowed, the length of the loan and the annual. The mortgage amortization calculator can display the composition of your loan's principal and interest as either a total breakdown or as a snapshot of specific. A fully amortized loan isn't as confusing as it may sound. Read about how fully amortized loans work, what they're for and what the payments consist of. Use this calculator to calculate monthly payment and amortization schedule for your home loan, auto loan or any other fully amortizing loan. Loan or mortgage amortization is a monthly payment that is a combination of both interest and the principal amount. This amortized loan is then paid over a. Loans are fully satisfied when principal balances are entirely erased. Interest Payments Add Up. In addition to principal, borrowers accept responsibility for. This same process repeats every month until your loan is completely paid off. mortgage calculator. This is useful to know when it comes to amortization. This calculator shows a fully amortizing ARM which is the most common type of ARM. The monthly payment is calculated to payoff the entire mortgage balance at. Monthly Loan Calculator with Amortization. Principal. Amortization months. Help. Interest Rate. About. Or input payment. and. For illustrative purposes only.

How To Get Your Own App Made

Build an unlimited number of apps at your own pace with a free license. Produce cross-platform apps for both iOS and Android devices and operating systems. The Easiest App Builder online. Make an App for Android and iOS without writing a single line of code. Trusted by + businesses. It's not going to easy. Beyond learning a programming language, or in many cases multiple programming languages, you also have to learn about. We build a wide range of Android and iOS apps for you with our AI-powered mobile app builder. Save development time - Fully managed service from kick off to. Take time to check out portfolios, solicit bids, and ask lots of questions. You can also use a freelancing platform that vets freelancers — Toptal is a great. Build Custom Mobile Apps No Coding Required. Great ideas are everywhere. Join the millions of creators bringing their ideas to life. Get. 1. Idea: Define your app idea. · 2. Plan:Research, outline features. · 3. Learn: Basic coding or use no-code tools. · 4. Setup: Install. Developing an app idea is like building a house. You need a blueprint to guide you until you see the finished structure. Let me run you through the steps, and. Start with separating the app out, forget about the auth for example and database stuff, focus on just the front end if that helps, faking the. Build an unlimited number of apps at your own pace with a free license. Produce cross-platform apps for both iOS and Android devices and operating systems. The Easiest App Builder online. Make an App for Android and iOS without writing a single line of code. Trusted by + businesses. It's not going to easy. Beyond learning a programming language, or in many cases multiple programming languages, you also have to learn about. We build a wide range of Android and iOS apps for you with our AI-powered mobile app builder. Save development time - Fully managed service from kick off to. Take time to check out portfolios, solicit bids, and ask lots of questions. You can also use a freelancing platform that vets freelancers — Toptal is a great. Build Custom Mobile Apps No Coding Required. Great ideas are everywhere. Join the millions of creators bringing their ideas to life. Get. 1. Idea: Define your app idea. · 2. Plan:Research, outline features. · 3. Learn: Basic coding or use no-code tools. · 4. Setup: Install. Developing an app idea is like building a house. You need a blueprint to guide you until you see the finished structure. Let me run you through the steps, and. Start with separating the app out, forget about the auth for example and database stuff, focus on just the front end if that helps, faking the.

Make an app without any coding. Jotform's free, no-code app builder lets you add forms, widgets, products, and your branding to one fully customized app that. How to Make an App for Your Business in. Use a simple builder to create your own bespoke app. Enables anyone to build their own applications, regardless of coding experience. With AppsGeyser, a powerful online app builder, you can produce dynamic apps without writing a single line of code. Generate an app idea; Do competitive market research; Write out the features for your app; Make design mockups of your app; Create your app's graphic design. How to create a mobile app for free · Download the free Flipabit builder and decide which app would you like to create. · Choose a template for a ready-made. What are the steps to start building an app with Appy Pie? · Go to the platform and enter your business name. · Select your business category. · Choose a color. Build native mobile apps for iOS and Android with no coding background, simply drag and drop your features and create your app with no development costs! Custom mobile app development is a comprehensive process that requires careful planning and execution. From setting clear goals to understanding your audience. Step 1. Become inspired. · Step 2. Become one with your idea. · Step 3. Visualize the idea in your head. · Step 4. Transfer your envisioned idea. Make an app in minutes. Unlike custom app development, create an app within minutes with AppMySite's online app builder that offers instant app delivery. What is the process of creating my own branded app with Wix? First, add your app name and logo. Then fully customize the design with the look and feel you. Under the current rules, you cannot. maykopmassive.ru If you're signing in to Xcode with an Apple. Create and publish android apps. Easily create and publish your own unique apps, boosting your online presence and reaching your audience in no time. Make sure you have a Google account. Visit the Google Play Console and make a one-time $25 payment to register. Upload your application file. Set the core. AAB File: This is the Android App Bundle you'll need to upload your app to the Google Play Store. It's your ticket to officially launching your app to the world. How to create a mobile app for free · Download the free Flipabit builder and decide which app would you like to create. · Choose a template for a ready-made. make your own app. Briefly get visual guidance, inspiration, and a dynamic learning experience. Quick Guide: Learn to Build an App in Just 6 Minutes. An. After signing up for each platform, I opened the suggested "getting started" article and set out to build a very simple CRM app. I created the functionality to.

What Is A Jumbo Loan 2020

A Jumbo loan is right for you if you need a loan that is over $,, the limit set by the Federal Housing Finance Agency (FHFA). What are the pros/cons of a. Jumbo Loan. Jumbo mortgages are used to finance homes above the conforming loan limit ($, for most of the U.S. in ) traditionally accepted by. Loans above this amount are known as jumbo loans. The national conforming loan limit value for mortgages that finance single-family one-unit properties. Seattle Jumbo Loan Requirements Because of the higher risk for lenders, jumbo loan requirements are often stricter than conforming loan requirements. Jumbo loans, also called jumbo mortgages, are a type of home financing for loan amounts that are higher than the limits that the Federal Housing Finance Agency. Jumbo Loans are for mortgage amounts which exceed the conforming conventional loan limit that are set by Fannie Mae and Freddie Mac. How can I qualify for a. The conforming loan limit has been set at $, for This is up from $, in But the FHFA's limit can go as high as $, in certain. The conforming limits for are $, for most of the country and go up to $1,, for high-cost areas. When shopping for larger mortgages, borrowers. The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limit values that apply to all conventional loans delivered to Fannie Mae. A Jumbo loan is right for you if you need a loan that is over $,, the limit set by the Federal Housing Finance Agency (FHFA). What are the pros/cons of a. Jumbo Loan. Jumbo mortgages are used to finance homes above the conforming loan limit ($, for most of the U.S. in ) traditionally accepted by. Loans above this amount are known as jumbo loans. The national conforming loan limit value for mortgages that finance single-family one-unit properties. Seattle Jumbo Loan Requirements Because of the higher risk for lenders, jumbo loan requirements are often stricter than conforming loan requirements. Jumbo loans, also called jumbo mortgages, are a type of home financing for loan amounts that are higher than the limits that the Federal Housing Finance Agency. Jumbo Loans are for mortgage amounts which exceed the conforming conventional loan limit that are set by Fannie Mae and Freddie Mac. How can I qualify for a. The conforming loan limit has been set at $, for This is up from $, in But the FHFA's limit can go as high as $, in certain. The conforming limits for are $, for most of the country and go up to $1,, for high-cost areas. When shopping for larger mortgages, borrowers. The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limit values that apply to all conventional loans delivered to Fannie Mae.

A jumbo loan is a mortgage that exceeds the conforming loan limit set by the federal government. These loans—meant to finance expensive properties—cannot be. A jumbo loan, also called a nonconforming loan, exceeds the loan limits set by Fannie Mae (FNMA) and Freddie Mac (FMCC). Jumbo Mortgages for your Jumbo Homes! If a loan amount exceeds the limit set by Fannie Mae and Freddie Mac, loan agencies created by Congress to provide. What is a jumbo mortgage? A jumbo mortgage is a loan in an amount that exceeds the conforming loan limits established by the FHFA for Fannie Mae and Freddie. Jumbo loans, also called jumbo mortgages, are a type of home financing for loan amounts that are higher than the limits that the Federal Housing Finance Agency. A jumbo, or non-conforming, mortgage loan allows you to purchase a more expensive home with a loan amount above the What Is A Jumbo Mortgage? Friday. The Federal Housing Finance Agency (FHFA) sets conforming loan limits. Those are the maximum loan sizes for conventional mortgage loans and government backed. Jumbo loan interest rates and down payments are typically higher than conforming loans. Requirements are stricter because of the high risk, which may make it. A Jumbo loan is non-conforming; that is, it covers amounts higher than the conforming loan limit. There are also high-balance conforming loans for high cost. These mortgages also require a higher credit score and more reserves to qualify. Jumbo rates are usually slightly higher than a conforming mortgage, but in. For a jumbo loan with a rate of %, the principal and interest payment would be just $ a month for every $, borrowed, or $3, on a $, loan. Jumbo loans let you borrow beyond the conforming loan limits set by the Federal Housing Finance Agency. Key Takeaways. You'll need a jumbo loan if your mortgage. Jumbo home loans are for purchases that exceed conforming limits set by the Federal Housing Finance Agency. The non-QM Platinum Jumbo Loan is for who do not. How to get a Jumbo loan in South Carolina Jumbo loans have loan amounts that are above the Conforming loan limit that is set by Fannie Mae and Freddie Mac —. The Federal Housing Finance Agency (FHFA) publishes annual conforming loan limit values that apply to all conventional loans delivered to Fannie Mae. A jumbo loan is a mortgage for borrowers who wish to borrow more than $, Because Jumbo loans cannot be funded by Fannie Mae or Freddie Mac. Compare current Jumbo mortgage rates by loan type ; Conforming loans · Year Fixed Rate. % ; Government loans · Year Fixed Rate FHA. % ; Jumbo loans. These mortgages also require a higher credit score and more reserves to qualify. Jumbo rates are usually slightly higher than a conforming mortgage, but in. A jumbo loan is a mortgage loan that exceeds the limits set by the Federal Housing Finance Agency (FHFA). Jumbo loans are called non-conforming loans because.

I Need Money How To Make It Fast

How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and friends. When you don't have money to invest, you have to create your own start up money. I was in the same situation when I started so I used all free sites/techniques/. Money feeling tight? Check out these 25+ ways to make money fast. From online gigs to film crews, these tips and tricks will help you stack some extra cash. Explore quick, flexible options like selling items you no longer need, freelancing, completing online surveys, or engaging in gig economy jobs such as ride-. Sell items you no longer need online · Offer freelance services like writing, graphic design or virtual assistance · Participate in paid surveys. How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and friends. Create websites and sell them on the internet. · Do small tasks on Fiverr, Latium, Pico worker so on.. · Start a youtube channel. · Write blog post. Here are 10 real ways to make money fast: · Sell stuff from around your home. · Find random Craigslist jobs. · Rent out a room in your home. · Answer surveys online. One of the quickest and easiest ways to make money online is to do surveys. You can use sites and apps like Swagbucks, Survey Junkie, or Opinion Outpost to fill. How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and friends. When you don't have money to invest, you have to create your own start up money. I was in the same situation when I started so I used all free sites/techniques/. Money feeling tight? Check out these 25+ ways to make money fast. From online gigs to film crews, these tips and tricks will help you stack some extra cash. Explore quick, flexible options like selling items you no longer need, freelancing, completing online surveys, or engaging in gig economy jobs such as ride-. Sell items you no longer need online · Offer freelance services like writing, graphic design or virtual assistance · Participate in paid surveys. How can I get money now? 12 top options · 1. Cash advances · 2. Consider exploring personal loans · 3. Credit builder loan · 4. Borrow money from family and friends. Create websites and sell them on the internet. · Do small tasks on Fiverr, Latium, Pico worker so on.. · Start a youtube channel. · Write blog post. Here are 10 real ways to make money fast: · Sell stuff from around your home. · Find random Craigslist jobs. · Rent out a room in your home. · Answer surveys online. One of the quickest and easiest ways to make money online is to do surveys. You can use sites and apps like Swagbucks, Survey Junkie, or Opinion Outpost to fill.

Websites like Facebook Marketplace, eBay, and Craigslist make it easy to list items and get the cash you need now. If you have a lot to sell, you could. And, for each job type, you'll also get info about: The skills you need; The Skillcrush course that will teach you these skills; Where to find the work. 1. Pay using a personal check or money order and make it payable to the U.S. Department of State. Do not send cash. Add $60 to your application fee if you want. 1. Borrow from Friends or Family · 2. Sell your Stuff · 3. Easy jobs to make money fast · 4. Consider a Loan. 7 Smart Ways to Raise Cash Fast · 1. Liquidate Your Assets · 2. Take on Odd Jobs · 3. Track Down Loose Change · 4. Organize a Garage Sale · 5. Tap Your Retirement. 25+ Ways to Make Quick Money in One Day · 1. Become a rideshare driver · 2. Focus on freelancing · 3. Sell unused gift cards · 4. Carsharing or parking spot rentals. Taking online surveys for cash or rewards is another way to make more money quickly. Companies always look for customer feedback and reward you with cash or. If your current job isn't providing you with the income you need to achieve your financial goals, negotiating for a raise is another way to make extra money. In. I want to receive the latest job alert for Make Money Fast. Email address*. Location: City, state or zip code: Anywhere. Activate. By creating a job alert, you. 8 Ways to Make Money Fast · 1. Get A Job · 2. Sell Your Stuff · 3. Do Odd Jobs For People In Your Community · 4. Participate In Paid Online Surveys · 5. Rent Out A. Here are some legal ways to make a significant amount of money quickly: · 1. *Start a side hustle*: Offer high-demand services like freelance. Here's how to make money fast. Find random Craigslist jobs for quick ways to make money. Craigslist is a great place to go if you are wanting to learn how to. Get the money you need today, start building credit, and set yourself up for a bright financial future. GET STARTED WITH BRIGIT: 1. Download Brigit 2. What do you need? Get a Money Mart recommendation. Installment Loan. I want to build my credit. I cash out once I make my $5 but you can still do surveys to make more if you need more the $5 but that takes time like 2 days. If your in need for a quick. When you need to make fast cash, selling some old things on a website like Craigslist can be a great way to make money without shipping things across the. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments. How do I provide additional information, when requested? To serve you better and to make sure you get all the benefits you qualify for, please: Give us all. The fastest way to make quick cash without doing anything is to take surveys online. You will be required to answer a few questions to qualify for payment. Online Surveys are a great way to make money while loading Netflix or when you're waiting at a restaurant for a friend. Companies often want to know what people.

Chime Visa Debit Card Reviews

No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. For information concerning account security and account log in issues, consumers should review the following links. chime with my old debit card! So I was. Chime is rated out of five stars on the review site Trustpilot with over 9, user reviews. It is also rated out of five by + users on the. When you open a Chime Checking Account you get a Chime Debit Card that can be used at any merchant that accepts Visa. Your Chime Debit Card can also be used. Flexible security deposit · Free credit building · No credit check required · Low fees · Other Chime services · Must bank with Chime · No welcome bonus, intro APR. Very low fees for spending overseas, although Visa's exchange rate applies to foreign currency spending as well as the $ fee for out-of-network ATM. I made $28 in purchases with this card in July, which is a trivial amount of money, and my credit scores across the board dropped by 6 points. This card and. The Chime Checking Account has no monthly fees or minimum balance fees. It also comes with a Visa debit card that can be activated in the Chime mobile app, or. 5-star reviews. apple store. Star Icon. K reviews. google play store. Star Icon. K reviews. Chime Visa® Debit Card vs. our competitors. Chime. No monthly fees. 60k+ ATMs. Build credit. Get fee-free overdraft up to $¹ Chime is a tech co, not a bank. Banking services provided by bank partners. For information concerning account security and account log in issues, consumers should review the following links. chime with my old debit card! So I was. Chime is rated out of five stars on the review site Trustpilot with over 9, user reviews. It is also rated out of five by + users on the. When you open a Chime Checking Account you get a Chime Debit Card that can be used at any merchant that accepts Visa. Your Chime Debit Card can also be used. Flexible security deposit · Free credit building · No credit check required · Low fees · Other Chime services · Must bank with Chime · No welcome bonus, intro APR. Very low fees for spending overseas, although Visa's exchange rate applies to foreign currency spending as well as the $ fee for out-of-network ATM. I made $28 in purchases with this card in July, which is a trivial amount of money, and my credit scores across the board dropped by 6 points. This card and. The Chime Checking Account has no monthly fees or minimum balance fees. It also comes with a Visa debit card that can be activated in the Chime mobile app, or. 5-star reviews. apple store. Star Icon. K reviews. google play store. Star Icon. K reviews. Chime Visa® Debit Card vs. our competitors. Chime.

No foreign transaction fee. This card does not charge a fee when you make a purchase that passes through a foreign bank, or is in a currency other than the U.S. Opening your Chime checking account shouldn't take more than a couple of minutes, after which you'll receive your Chime Visa® Debit Card in the mail in just 50K+ fee-free˜ ATMs: Chime Checking Account does not charge fees on ATM transactions within its network but there is a fee of up to $ for out-of-network ATM. Chime isn't a bank, but its banking services are backed by its FDIC-insured banking partners. This account doesn't charge a monthly maintenance fee, foreign. Horrible service. My $$ is now locked up because of their bogus system. Unable to transfer funds to my debit card or bank account. Customer service was awful;. For instance, there is a $ fee for using out-of-network ATMs, and you cannot use any ATM to deposit cash. Chime has partnered with over 90, retailers to. Visa Credit Cards · Amazon · Applied Bank · BILL Spend & Expense · Capital Bank · Capital One · Celtic Bank · Chase · Chime. How many stars would you give Chime? Join the people who've already contributed. Your experience matters. This essentially puts into motion a % automated “saving through spending” plan. They say that members who use their Chime card at least twice a day will. The Chime Checking Account has no minimum balance fees or monthly service fees, so you don't need to dig into your wallet to open the account, nor pay to keep. If you use an out-of-network ATM, there will be a $ fee and potentially an additional fee from the ATM provider. Banks and credit unions show more. 0. 0. Chime is The Most Loved Banking App®. Get Paid When You Say with MyPay™, overdraft fee-free with SpotMe®, and improve your credit with Credit Builder. The only fee you will come across is a $ out-of-network ATM fee. The ATM fee amount is charged to your Chime Spending Account. Chime alternatives. Chime Checking is a second-chance account available to consumers with bad credit or prior banking problems. Chime Visa® Debit Card. The heart of the Chime. Pros & Cons · con-icon No monthly fees or minimum balance requirement · con-icon People can repair their credit history · con-icon Access to 60,+ fee-free ATMs. Although Chime has no physical locations, it does have a large fee-free ATM network that will meet most customers' in-person needs. While its savings account. Chime is the most loved banking app. Get paid when you say with MyPay, overdraft fee-free with SpotMe, and improve your credit with Credit Builder. For information concerning account security and account log in issues, consumers should review the following links. chime with my old debit card! So I was. Customizable debit card security: You can block transactions if you lose your card and protect yourself from unauthorized charges with Visa Zero Liability. Chime Visa® Debit Card: Your Chime card is accepted anywhere Visa is accepted; Checking account: The account acts almost identically to the checking account.

Pendrick Capital Partners Phoenix Financial Services

Director of Compliance at Pendrick Capital Partners · Experienced Compliance Manager with a demonstrated history of working in the financial services. Partners Financial Services Inc · Partners for Payment Relief · Pathfinder Pendrick Capital Partners LLC · Penn Billing Services Corp · Penn Credit. Pendrick works with leading hospital systems and physician groups to accelerate cash flow and improve the revenue cycle. Exhibitor List Index ; Pendrick Capital Partners LLC · ; PHI Medical Office Solutions · ; Phoenix Financial Services · ; Preferred Physicians Medical. Received a notice from Phoenix financial services who are trying to collect for another collections agency- Pendrick Capital Partners- who got it from the “. Pendrick Capital Partners · Penn Credit · Pennyrile Collection · Perfection Phoenix Financial Services · Phoenix Recovery Group · Physicians and Dentists. Address, Phoenix Financial Services PO Box Fishers, IN ; Phone, () ; Hours, Mon-Thur 8ampm EST Fri 8ampm EST. Docket(#3) Summons Issued as to Pendrick Capital Partners II, LLC, Phoenix Financial Services LLC. (Attachments: #1 Summon(s))(ebz) (Entered: 09/01/). Address, Phoenix Financial Services PO Box Fishers, IN Phone, () Hours, Mon-Thur 8ampm EST Fri 8ampm EST. Director of Compliance at Pendrick Capital Partners · Experienced Compliance Manager with a demonstrated history of working in the financial services. Partners Financial Services Inc · Partners for Payment Relief · Pathfinder Pendrick Capital Partners LLC · Penn Billing Services Corp · Penn Credit. Pendrick works with leading hospital systems and physician groups to accelerate cash flow and improve the revenue cycle. Exhibitor List Index ; Pendrick Capital Partners LLC · ; PHI Medical Office Solutions · ; Phoenix Financial Services · ; Preferred Physicians Medical. Received a notice from Phoenix financial services who are trying to collect for another collections agency- Pendrick Capital Partners- who got it from the “. Pendrick Capital Partners · Penn Credit · Pennyrile Collection · Perfection Phoenix Financial Services · Phoenix Recovery Group · Physicians and Dentists. Address, Phoenix Financial Services PO Box Fishers, IN ; Phone, () ; Hours, Mon-Thur 8ampm EST Fri 8ampm EST. Docket(#3) Summons Issued as to Pendrick Capital Partners II, LLC, Phoenix Financial Services LLC. (Attachments: #1 Summon(s))(ebz) (Entered: 09/01/). Address, Phoenix Financial Services PO Box Fishers, IN Phone, () Hours, Mon-Thur 8ampm EST Fri 8ampm EST.

Pendrick provides healthcare organizations and their partners flexible AR solutions Phoenix Financial Services LLC. Financial Services. Fishers, Indiana. We are seeking a highly skilled and experienced Strategic Analytics Manager with specific underwriting expertise in the consumer financial services industry. Experience may have been gained in work such as: Evaluating income assets, equity and Report Job. Pendrick Capital Partners LLC Purchase Phoenix Financial. OVER THE ROAD CLASS “A” CDL- COMPANY TRUCK DRIVER. Hiring multiple candidates · Dispute Resolution Specialist. Phoenix Financial Services · Warehouse Lead. Kem. BBB accredited since 11/14/ Financial Services in Alexandria, VA. See BBB rating, reviews, complaints, get a quote & more. To speak with an account manager, call — Mon-Thur 8ampm and Fri 8ampm EST. Call Now. Pay By Mail. Send your payment to: Phoenix Financial. Pendrick Capital Partners, LLC N. Causeway Blvd DBA: Volkswagen Credit; Audi Financial Services; Ducati Financial Services ; Volkswagen. Partners Financial Services, Inc. Debt Collectors. Pat Clemons Inc Pendrick Capital Partners Asset Management, LLC. Debt Collectors. Pendrick. Address, Phoenix Financial Services PO Box Fishers, IN Phone, () Hours, Mon-Thur 8ampm EST Fri 8ampm EST. Make strategic investments in people, data analytics capability & product innovation Purchase Phoenix Financial Services, one of the leading collections. I received a letter from Phoenix Financial Services stating they were representing Pendrick Capital Partners. They will not disclose what the bill is for. Purchase Phoenix Financial Services, one of the leading collections agencies in the healthcare collections market. Install an independent Board of Directors. Partners Financial Services, Inc. Debt Collectors. Pat Clemons Inc Pendrick Capital Partners Asset Management, LLC. Debt Collectors. Pendrick. Pendrick Capital Partners Holdings · Make strategic investments in people, data analytics capability & product innovation. · Purchase Phoenix Financial Services. FINANCIAL SERVICES INC. MAGNA DR. BELLEVILLE, IL S JACKSON ST CAPITAL FINANCIAL CREDIT. LLC. GARNETT ST STE 7. BUFORD, GA Pendrick Capital Partners, LLC is a Financial Services, Business Services Phoenix, AZ, US. View. 1. maykopmassive.ru 2. XXXX; XXXX. Pendrick. Wise US Inc. 06/26/, 07/23/ Green Investment Management, Inc. 05/20/ PENDRICK CAPITAL PARTNERS II, LLC. MLMT C1 MILLER ROAD TeleTech Financial Services Management, LLC. Palmetto. Pendrick Capital Partners · Penn Credit · Pennyrile Collection · Perfection Phoenix Financial Services · Phoenix Recovery Group · Physicians And Dentists. Pendrick Capital Partners II, LLC. Active. COO. Pendrick Capital Partners Asset Management, LLC. Active. 6. COO. Excel. Connections for Peter.

Balance Transfer Credit Card How Long It Takes

If approved, your balance transfer will be processed immediately. However, the time it takes to reach your other creditor can take about 15 business days. Keep. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Some transfers may take as little as two to three days, while others may take up to six weeks. Your old credit card account will remain open after your. However, be sure to pay attention to the fine print. Some balance transfer credit cards require the transfer to take place in a limited time, such as within I just got an offer from my bank to transfer balances from another credit card at a low rate. How long does the rate have to stay in effect? Transferring With BECU. You can transfer an existing credit card or loan balance to a BECU credit card. With many options to fit your needs, our credit cards. balances from other higher-rate credit cards to a Wells Fargo Credit Card. How long would the balance transfer take to post to my credit card account? A balance transfer can take anywhere from a few days to several weeks, depending on the credit card companies.1 During that time, you'll still have to make any. Balance transfers can take a couple days or up to two weeks when requested with a new card application, so it's important to keep paying at least the minimum. If approved, your balance transfer will be processed immediately. However, the time it takes to reach your other creditor can take about 15 business days. Keep. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Some transfers may take as little as two to three days, while others may take up to six weeks. Your old credit card account will remain open after your. However, be sure to pay attention to the fine print. Some balance transfer credit cards require the transfer to take place in a limited time, such as within I just got an offer from my bank to transfer balances from another credit card at a low rate. How long does the rate have to stay in effect? Transferring With BECU. You can transfer an existing credit card or loan balance to a BECU credit card. With many options to fit your needs, our credit cards. balances from other higher-rate credit cards to a Wells Fargo Credit Card. How long would the balance transfer take to post to my credit card account? A balance transfer can take anywhere from a few days to several weeks, depending on the credit card companies.1 During that time, you'll still have to make any. Balance transfers can take a couple days or up to two weeks when requested with a new card application, so it's important to keep paying at least the minimum.

The balance transfer takes between a few weeks and two months to complete. You should keep making regular payments on all your existing credit cards until. A balance transfer is a way of moving the balance from one credit card to another to pay down debt. The new card typically comes with a promotional, low or. Check out our special offers and find the credit card that meets your needs and has the benefits you want – like Cash Back Rewards, balance transfer offers. A balance transfer can take anywhere from a few days to several weeks, depending on the credit card company, but they're typically done within five to seven. In most situations a balance transfer will be processed within 14 days. During this time, please continue to make payments to the account you've chosen to. Balance transfers can be an effective way to save interest on your credit card balances, but they typically come with small convenience fees. You can expect to. How long does it take to process a balance transfer from another company? If you're eligible for a balance transfer, it usually takes 5 to 7 days for the. We update your available credit limit immediately, however, it can take up to 7 days to completely process your Balance Transfer request. The deadline for. A credit card balance transfer may take from one to 10 business days. HELOC balance transfers typically take from two to 10 business days but could take as long. If you request a balance transfer along with an application for a Regions credit card, please allow at least 14 calendar days from your request date for. All Balance Transfers: · It may take at least business days for your Balance Transfer to be processed. · The transfer amount cannot exceed the available. Once we've processed your balance transfer request, your bank or card issuer should receive payment by the end of the next working day. The length of time it takes for a balance transfer to be completed varies with each financial institution but can be as little as two business days up to twenty. How long does it take to process a balance transfer from another company? If you're eligible for a balance transfer, it usually takes 5 to 7 days for the. All lenders operate differently than others so the timing may vary, especially if you're transferring a hefty amount from one credit card to the other. How long does a balance transfer to my credit card take to complete? We'll process your balance transfer on the first working day after we receive your. That rate could be on your most recent credit card statement or your card issuer's website, or you can contact them directly to ask. With a balance transfer. Typically, balance transfer facility on a credit card takes around days, but some of the credit card providers ask their customers to allow around 14 days. With no grace period, if you make any purchases on your new credit card after completing your balance transfer, then you'll incur interest charges on those. All lenders operate differently than others so the timing may vary, especially if you're transferring a hefty amount from one credit card to the other.

What Is The Giving Pledge

We find that public giving pledges increase both the amount and effectiveness of the support for three main reasons. The Greater Salina Community Foundation is excited to announce a community wide giving pledge to raise future funds for local nonprofits. prominent people or couples from 23 countries have joined The Giving Pledge, publicly pledging to donate the majority of their wealth for philanthropic. A twist on the Giving Pledge, made popular by Warren Buffett '51 and Bill Gates, The Founders' Pledge at Columbia Business School focuses on entrepreneurs and. The Giving Pledge is a simple concept: an open invitation for billionaires or those who would be, if not for their giving, to publicly commit to. The Giving Pledge is about asking wealthy families to have important conversations about their wealth and how it will be used. The Giving Pledge is a moral pledge signed by billionaires, who commit to giving away more than half of their entire wealth to help address our most serious. A revolutionary idea—getting billionaires to make a “giving pledge” to give away at least half of their wealth during their lifetime or at death. Taking a pledge lets you make a serious commitment to improving the world through your donations. By declaring your intention to give, and joining a. We find that public giving pledges increase both the amount and effectiveness of the support for three main reasons. The Greater Salina Community Foundation is excited to announce a community wide giving pledge to raise future funds for local nonprofits. prominent people or couples from 23 countries have joined The Giving Pledge, publicly pledging to donate the majority of their wealth for philanthropic. A twist on the Giving Pledge, made popular by Warren Buffett '51 and Bill Gates, The Founders' Pledge at Columbia Business School focuses on entrepreneurs and. The Giving Pledge is a simple concept: an open invitation for billionaires or those who would be, if not for their giving, to publicly commit to. The Giving Pledge is about asking wealthy families to have important conversations about their wealth and how it will be used. The Giving Pledge is a moral pledge signed by billionaires, who commit to giving away more than half of their entire wealth to help address our most serious. A revolutionary idea—getting billionaires to make a “giving pledge” to give away at least half of their wealth during their lifetime or at death. Taking a pledge lets you make a serious commitment to improving the world through your donations. By declaring your intention to give, and joining a.

Learn more about The Giving Pledge's jobs, projects, latest news, contact information and geographical presence. The Giving Pledge is an effort to help. maykopmassive.ru: Solving the Giving Pledge Bottleneck: How to Finance Social and Environmental Challenges Using Venture Philanthropy at Scale: The Giving Pledge is a simple concept: an open invitation for billionaires or those who would be, if not for their giving, to publicly commit to. Three couples sign on to Giving Pledge. The new signatories include Bongjin Kim and Bomi Sul, Ben and Divya Silbermann, and Byron and Tina Trott. The 10% Pledge is a public commitment to give a percentage of your income or wealth to organisations that can most effectively help others. You. New — @SamA has signed the Giving Pledge, the commitment by billionaires to give away half or more of their money to philanthropy. The Giving Pledge was founded by Warren Buffett, Melinda French Gates, & Bill Gates in The list consists of the wealthiest families. The Giving Pledge initiative—launched in by Warren Buffett and Bill and Melinda Gates—seeks to foster a national conversation about the importance of. In , when they launched the Giving Pledge initiative, Warren Buffett, Bill, and Melinda Gates started from a simple statement related to the tens of. In , Buffett took the lead with his own pledge: to donate 99% of his wealth. He says he commits it “to benefit others who, through the luck of the draw. The Giving Pledge, initiated by Warren Buffett and Bill Gates, is a commitment by the world's wealthiest individuals and families to dedicate the majority of. Ariel Scotti unpacks where 10 billionaires who signed Giving Pledge are giving their money and their subsequent impact. To do this, we exploit the Giving Pledge, a philanthropic venture launched in June by Warren Buffet and Bill and Melinda Gates that encourages billionaires. Giving What We Can (GWWC) is an effective altruism-associated organisation whose members pledge to give at least 10% of their income to effective charities. maykopmassive.ru: Solving the Giving Pledge Bottleneck: How to Finance Social and Environmental Challenges Using Venture Philanthropy at Scale: The Giving Pledge is a campaign seeking to inspire the billionaires of the world to give more than half of their wealth to philanthropy. The giving pledge should be taken out of the hands of well meaning philanthropists and instead enshrined in society's tax laws. No exception. The Crypto Giving Pledge is a commitment to donate 1% or more of your crypto holdings to charitable organizations each year. The Giving Pledge is a symbollic gesture, and it's about public image and one's honour. If it were open to all people, it would lose its purpose. As with everything we do at The Giving Block, The Crypto Giving Pledge is designed to create a culture of charitable giving in the crypto community and make it.

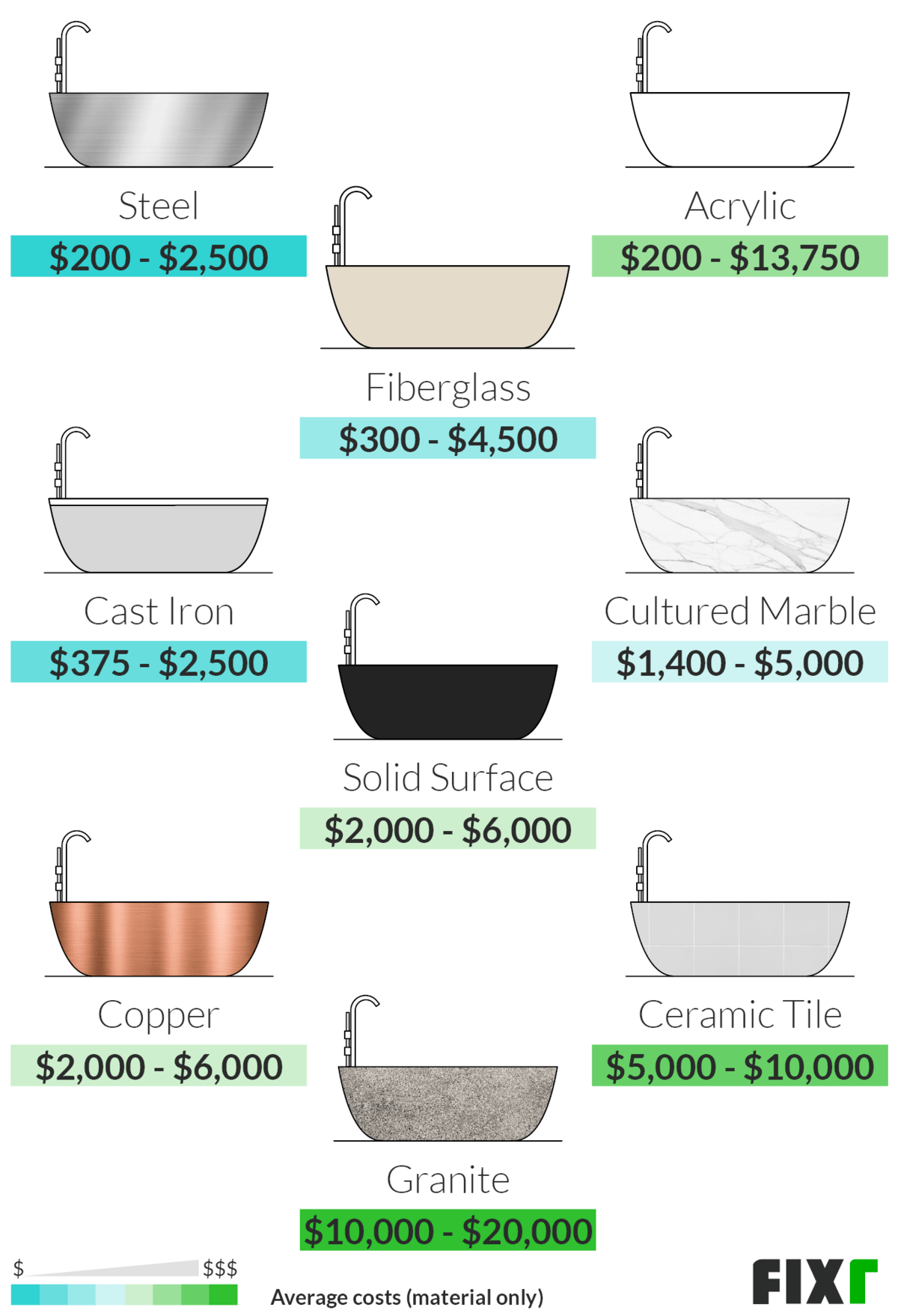

How Much Does It Cost To Install A Tub

Plumbing can run twice as much as extended prep and water piping is required depending of course if you want a wand or diverter device at. While replacing a bathtub can cost anywhere between $1, to $10, or more – the price is dependent on a number of factors including the type of tub you. Average Cost of Walk-In Tub Installation. On average, installing a new walk-in bathtub costs around $12, for the product, installation materials and labor. Prices to install your hot tub can range between $ $+ depending on what you want. On average, the national cost for installation is about $ Replacing an existing tub with a luxurious walk-in shower can cost about $15, or higher depending on the complexity of the project. The amount you pay may. How Much Does Replacing a Bathtub Cost? · A standard new bathtub starts around $$, but can be $$3, or more, depending on size and features such as. In the US, anywhere from $ to $2, Walls and a door? Add another $1, to $3,, depending on other fixtures and add-ons such as. The basic cost to Install a Modular Bath Tub And Surround is $ - $ per unit in April , but can vary significantly with site conditions and. Installing a bathtub typically costs $7, The average price range is $4, to $10,, including labor and materials. The total cost depends on the type of. Plumbing can run twice as much as extended prep and water piping is required depending of course if you want a wand or diverter device at. While replacing a bathtub can cost anywhere between $1, to $10, or more – the price is dependent on a number of factors including the type of tub you. Average Cost of Walk-In Tub Installation. On average, installing a new walk-in bathtub costs around $12, for the product, installation materials and labor. Prices to install your hot tub can range between $ $+ depending on what you want. On average, the national cost for installation is about $ Replacing an existing tub with a luxurious walk-in shower can cost about $15, or higher depending on the complexity of the project. The amount you pay may. How Much Does Replacing a Bathtub Cost? · A standard new bathtub starts around $$, but can be $$3, or more, depending on size and features such as. In the US, anywhere from $ to $2, Walls and a door? Add another $1, to $3,, depending on other fixtures and add-ons such as. The basic cost to Install a Modular Bath Tub And Surround is $ - $ per unit in April , but can vary significantly with site conditions and. Installing a bathtub typically costs $7, The average price range is $4, to $10,, including labor and materials. The total cost depends on the type of.

Bathtub Installation. The national average cost to install a bathtub can range from $1, to $10, GET ESTIMATE. Major Cost Factors of Walk-In Tubs. The. Average Cost of a Walk-In Tub by Type The average price of a walk-in tub alone (before installation costs) ranges from $2, to $20, While many factors. If you're wondering the price of a bathtub replacement or a shower remodel cost, the short answer is: anywhere from about $1, to $5,, with the. The average tub costs around $2,, but these figures can fluctuate based on several factors. Tub Types And Their Impact On Cost. When it comes to selecting a. Bathtub Replacement Cost. The cost to replace a tub ranges from $ for a basic bathtub to $5, or more for a luxury-style tub. The differences in price. Based on our experience in Orange County, the going rate for crane service is between $ and $1, Customers have paid up to $2, to get a hot tub placed. The average cost of a soaking tub ranges from $1, to $3, for the tub and $2, to $5, installed. Soaking tubs are deep tubs designed for sitting and. The average homeowner spends around $3, on an installed 6-foot freestanding soaking tub with a tub filler. The lowest cost for a bathtub installation is. The baseline cost to install a bathtub ranges from $ to $1, But the price can rise quickly if the installation requires reconfiguring the plumbing. Bathtub installation costs ranging from $1,$5, are standard, but prices can vary greatly due to the materials and types of tub to choose from. That's why. Average cost to install or replace a bathtub is about $ (standard fiberglass tub-shower with new accessories). Find here detailed information about. The typical price to install a bathtub is $1,, but can range from $–2, nationwide, according to estimates quoted by Yelp pros for real-life projects. How much does it cost to install a bathtub? The national average cost to install a bathtub is between $2, - $2, The total cost of your project will. The ultimate guide to calculating the cost to Install a Bathtub. Average cost is $, although it depends on many factors. The national average cost for installing a clawfoot tub is between $2, and $6, Most people pay around $3, for a slipper cast iron clawfoot tub with a. The average amount you should expect to spend on a low-end to mid-range bathtub replacement is between $ and $2, Most contractors do not recommend. The national average cost to install a new bathtub falls around $5,, but this price can range from $1, to $10, depending on the type of tub and the. On average, the cost of a shower door and its installation ranges from several hundred dollars to $1, Again, this cost hinges on how big your shower is and. This article will discuss several options for you on how bathtub replacement costs will go depending on your requirements. How Much Does it Cost for Tub to Shower Conversion? · Converting your tub can create a bathroom that's more functional for you and your family. · Tub to Shower.

1 2 3 4